buying guide

investor-tips

portfolio ops

finance ops

AI CFO, Fractional CFO, or Finance Copilot: What Makes Sense at Sub $1M, $1-5M, and $5-10M ARR

Adhrita Nowrin

Nov 20, 2025

Choose a finance copilot or AI CFO under $1m ARR for clarity and cadence, layer a fractional CFO from $1–5m when judgement and pricing decisions increase, and combine fractional CFO depth with AI CFO automation by $5–10m for proper FP&A and board governance.

Key Facts:

Sub $1M ARR requires runway visibility, KPI hygiene, and investor-ready numbers.

$1–5M ARR requires budget cycles, scenario planning, cohort retention, margin analysis, and pricing checks.

$5–10M ARR requires formal FP&A, variance analysis, debt scheduling, and board-level reporting.

An AI CFO or finance copilot manages data pipelines, reporting, definitions, and alerts.

A fractional CFO adds judgement, negotiation, strategic modelling, and governance.

askRIA operates as the finance copilot and AI CFO layer and pairs with fractional CFOs to deliver board-grade FP&A.

Definitions and formulas:

Runway (months): Bank balance ÷ monthly net burn.

Net burn: Operating cash outflows minus inflows from operations, excluding financing.

CAC payback (months): Acquisition cost ÷ monthly gross profit of the acquired cohort.

NRR: (Starting cohort revenue + expansion − churn − contraction) ÷ starting cohort revenue.

Contribution margin: Revenue − variable costs tied to service delivery.

Why this guide exists

Most content on AI CFOs or virtual CFOs focuses on features. Very little explains the real thresholds where a founder should change their finance stack. This guide helps you avoid overpaying too early or staying under-tooled when complexity arrives.

Stage 1: Sub $1M ARR | Keep the stack lean and automate the basics

What you actually need

True runway math that ties directly to bank balance and burn.

KPI hygiene: ARR, NRR, gross margin, CAC payback corridor, burn multiple.

A clean monthly close and a simple rolling 12-month forecast.

Basic cohorts to monitor retention shape.

Best fit

Finance copilot or AI CFO.

Handles close, reporting, cohort views, payback windows, and investor-ready packs with minimal effort.

What to avoid

Full-time CFO.

At this stage you pay for judgement you rarely use.

Expected outputs

Monthly KPI pack

Bank-to-P&L reconciliation

Runway tracker

Early pricing and discount insights

Stage 2: $1–5M ARR | Add judgement and structured decision support

What you actually need

Budget cycles tied to hiring plans and pipeline health

Scenario modelling across pricing, channels, and product mix

Retention and margin analysis by plan or SKU

Pricing and packaging tests with a clear corridor for movement

Best fit

AI CFO plus light fractional CFO.

AI manages data integrity and reporting.

Fractional CFO reviews assumptions, challenges pricing, aligns expectations, and supports financing conversations.

Expected outputs

Driver-based model

Quarterly budget and reforecast

Board update pack

Cohort and margin analysis

Pricing test results

Stage 3: $5–10M ARR | Formal FP&A and board-grade governance

What you actually need

Proper FP&A cadence with forecast accuracy targets.

Detailed variance analysis with owners and corrective actions

Cash planning that incorporates debt schedules and collections

Policies and controls that withstand investor diligence

Best fit

Fractional CFO plus AI CFO.

Fractional CFO leads planning and board dialogue.

AI CFO maintains data pipelines, monitoring, and recurring analytics.

Expected outputs

Quarterly budget and forecast

Board deck with risks, variances, and margin detail

Cash and debt schedule

Segment-level margin improvement plan

Quick chooser table

Messy numbers and late reporting → Finance copilot or AI CFO

Pricing or channel changes with strategic decisions → Add fractional CFO time

Board demands FP&A cadence and controls → Fractional CFO plus AI CFO

Red flags that say you are under-tooled

Runway in the deck does not match bank and burn.

No cohort view in a subscription or usage model.

Forecast contains no driver logic.

Board packs without cash and margin truth.

Where askRIA Fits

askRIA delivers the finance copilot and AI CFO layers: automated close, KPI standardisation, cohorts, payback, runway, and alerts.

The platform integrates quickly with your finance stack and works smoothly alongside fractional CFOs to produce consistent FP&A without spreadsheet chaos.

FAQs

1) When is an AI CFO or finance copilot enough?

Sub $1M ARR and early $1–5M ARR when the needs are runway clarity, KPI hygiene, investor-ready numbers, and light scenario planning.

2) When should you add a fractional CFO?

Around $1–5M ARR when pricing, contracts, or debt add complexity and certainly by $5–10M ARR for FP&A and board expectations.

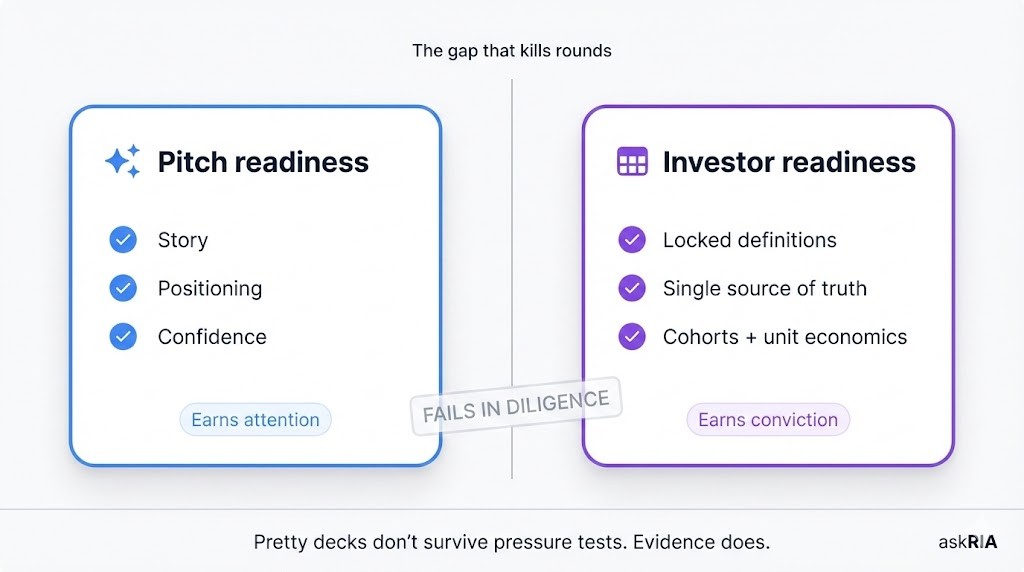

3) What is the split of work between AI CFO and fractional CFO?

AI layers handle reporting, cohorts, payback, runway, and alerts. Fractional CFOs handle decision-making, negotiation, and board communication.

4) Can askRIA replace a fractional CFO?

askRIA replaces manual finance operations and analytics. Fractional CFOs remain important for governance and high-judgement financial decisions as you scale.