Fractional CFO

Financial Model

Funding Tips

Your Financial Model Is Lying to You

Adhrita Nowrin

Mar 15, 2025

Your Financial Model Is Lying to You

💡 It’s not that your numbers are wrong.

It’s that they’re believable lies.

Growth curves that hockey-stick in month 6.

CAC that somehow drops with scale.

Churn so low it sounds like magic.

Margins that would make Apple blush.

We’ve all done it.

Built a spreadsheet to “show potential”, but ended up fabricating a reality no one believes.

And then we wonder why investors ask the same questions:

“How did you get these numbers?”

“What’s your assumption here?”

“Can we run a sensitivity on that?”

They’re not doubting you.

They’re doubting the fiction you were taught to present.

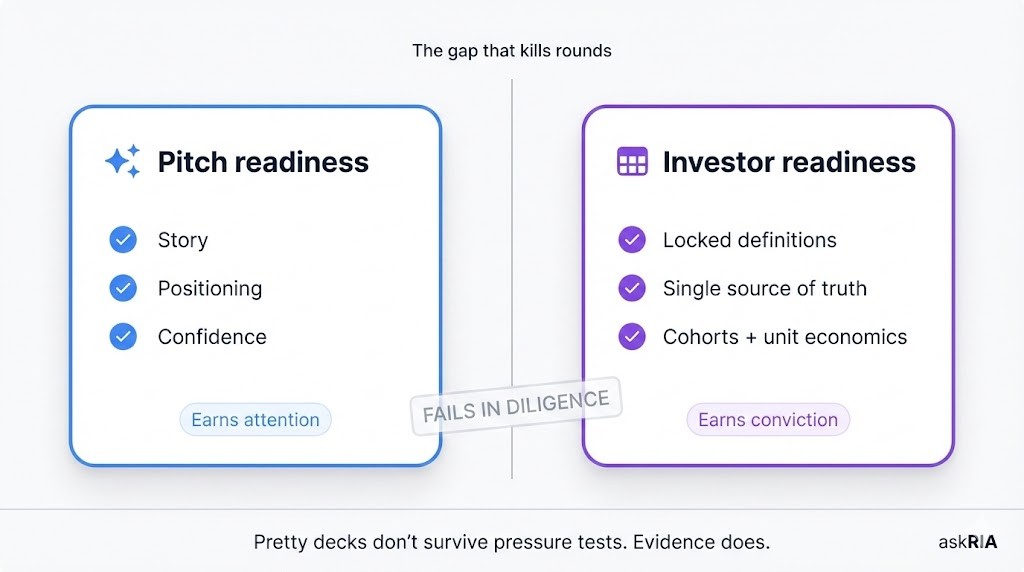

🧠 Why Most Financial Models Break Trust

1. They tell a story the founder doesn’t understand.

You used a template.

You filled in cells.

But you can’t explain the logic behind the margin model.

That’s not impressive. That’s risky.

2. They ignore reality.

No model survives first contact with real CAC.

Your conversion rate isn’t 20% unless you’re running a cult.

3. They don’t scale like the business does.

Costs don’t grow linearly.

Neither does revenue.

But somehow, your spreadsheet thinks they do.

🧮 What a Good Financial Model Actually Does

Reflects how you think, not just how you dream

Makes assumptions visible and debatable

Allows you to simulate, not sell

Doesn’t tell a perfect story, tells an honest one

A model should make your brain sharper, not your story smoother.

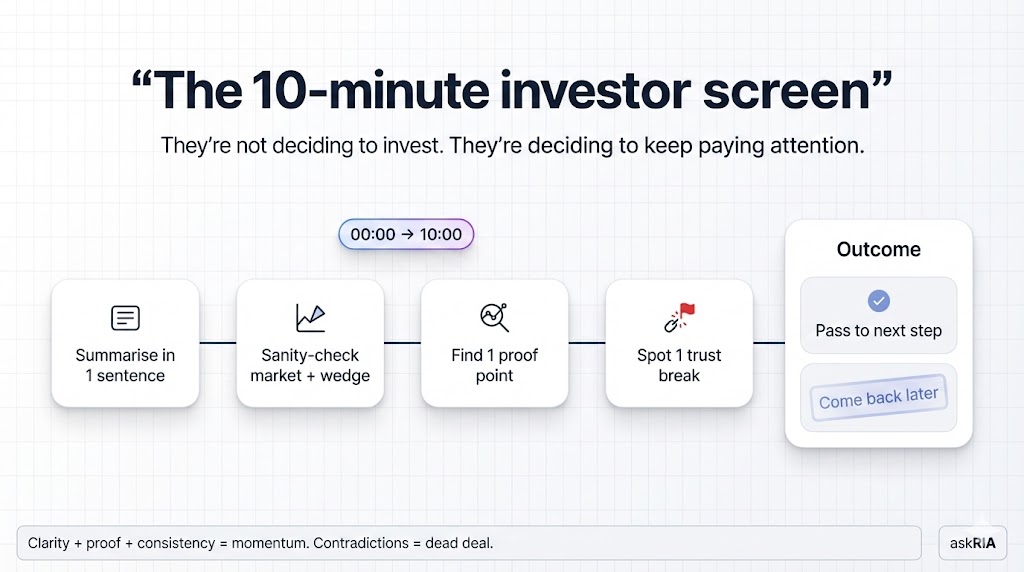

🔁 How Investors Actually Use Your Model

They don’t care about your revenue in year five.

They care about:

How you think about growth

Whether your cost base is rational

If you understand cash runway, headcount, margins

Whether you can make good decisions under uncertainty

A spreadsheet isn’t just a forecast.

It’s a diagnostic. A mirror. A trust test.

💥 Common Mistakes That Kill Credibility

Setting CAC too low because “we’ll get better with scale”

Ignoring burn rate in favor of top-line dreams

Not including runway vs. milestones

Using color-coded tabs with no logic behind them

✍️ A Better Way to Model

Start with first principles: What do we actually know?

Build up from real costs, not from dreams

Use ranges, not fixed numbers

Create 3 scenarios: conservative, likely, aspirational

Share the assumptions before the numbers

🧘 Final Thought

A good financial model doesn’t convince investors.

It grounds you.

It helps you sleep.

It helps you say no to bad decisions and bad deals.

And when the market shifts, it helps you survive.

Because survival isn’t driven by forecasts.

It’s driven by clarity.