Fundraising

investor-tips

due-diligence

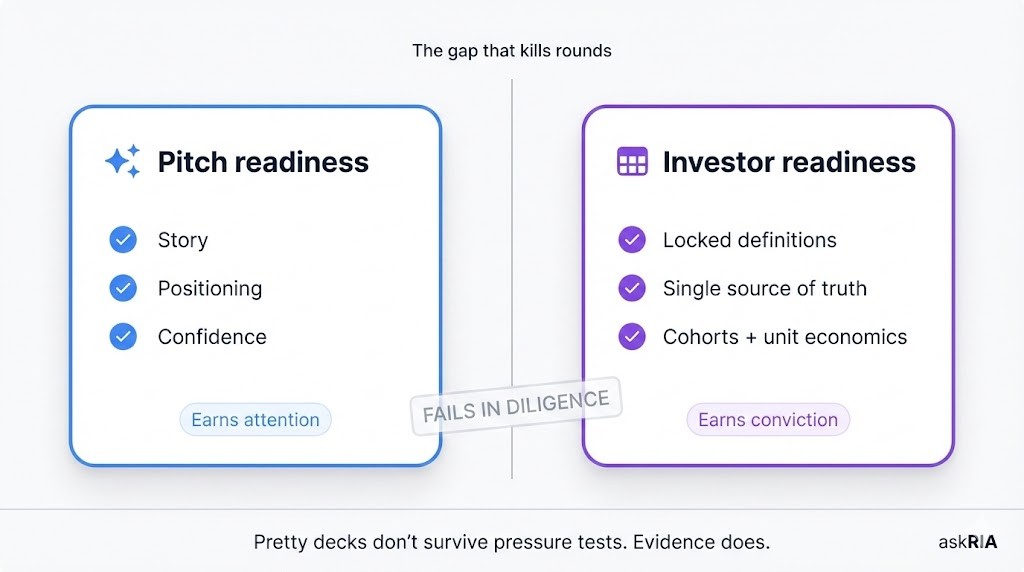

Investor Readiness Is Not Pitch Readiness

Adhrita Nowrin

Jan 27, 2026

Founders polishing decks but still failing raises.

What’s the difference between pitch readiness and investor readiness?

Pitch readiness is about storytelling and presentation. Investor readiness is about whether the business holds up when assumptions are challenged.

A deck can be sharp and still die quickly.

Not because investors are cruel. Because venture is a risk business operating under time pressure.

And risk businesses look for fast disqualifiers and fast paths to conviction.

What pitch readiness optimises for

Pitch readiness is performance.

It optimises for:

Narrative flow

Clear positioning

Confident delivery

Memorable framing

A story that feels inevitable

Pitch readiness earns attention.

It does not earn conviction.

What investor readiness optimises for

Investor readiness is structural.

It optimises for:

KPI definitions that stay stable across deck, model, and updates

A single source of truth tied to bank, invoices, and contracts

Drivers that survive scenario stress

Cohorts and unit economics that predict behaviour

Fast answers to sceptical questions

This is what diligence is for.

Not to admire the story. To test whether the business holds.

Where great decks usually break

The gap between pitch readiness and investor readiness shows up in the same places again and again.

1) KPI definition drift

ARR changes meaning across files. Revenue includes different things in different contexts.

When definitions drift, trust collapses.

2) Model fragility

The model only works if assumptions stay perfect.

Change hiring pace, pricing, or conversion, and everything breaks.

3) Cohort blindness

Recurring revenue without segmented cohort views.

Cohorts without discount flags.

Expansion confused with promo recovery.

4) Unit economics handwaving

Blended CAC.

Unmapped cost to serve.

Payback that exists only in theory.

5) Update chaos

Metrics change. Definitions change. Narratives shift.

Investors stop tracking progress because there is nothing stable to track.

Examples of “great decks” that didn’t raise

You have seen these, even if no one admits it:

Gorgeous narrative, unclear engine: growth exists, but no one can explain why it happens or whether it repeats.

Big market, weak wedge: the TAM slide is huge, but the initial customer is vague and the buying trigger is fuzzy.

Strong top-line, broken economics: growth is paid for with discounts or channels that cannot scale.

Confident claims, thin evidence: every slide is an assertion with no proof points behind it.

A great deck can hide these issues. Diligence exposes them.

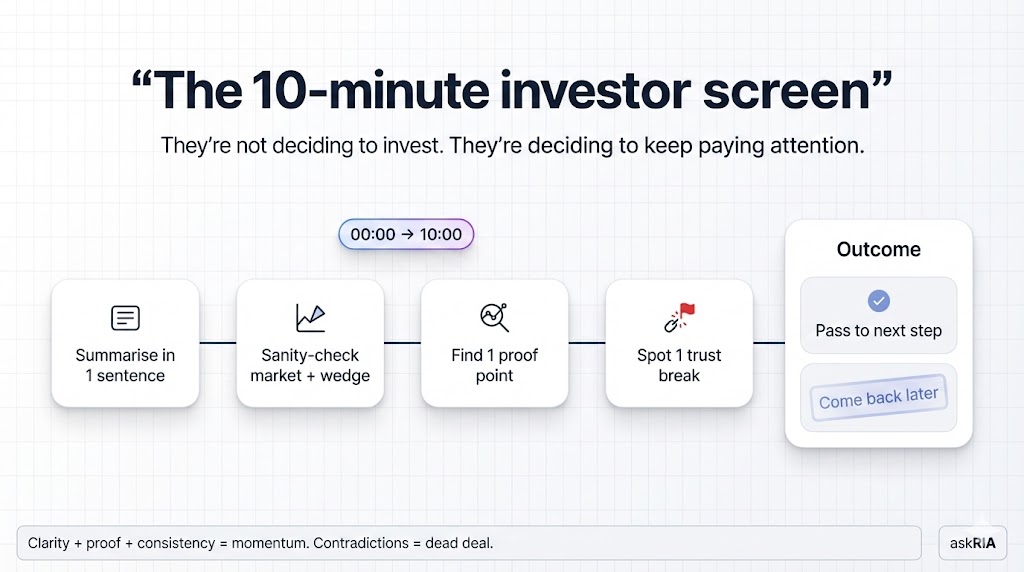

How investors pressure-test readiness internally

You might think the decision is made in the meeting.

Often, the meeting is just the start of an internal process where someone has to build the conviction case.

Here are the internal questions that kill weak raises:

1) “Do the numbers reconcile?”

Bank balance matches runway maths

Burn is consistent across statements

Revenue definitions are stable

2) “Does retention create a path to scale?”

Cohorts flatten, or at least improve over time

Expansion happens after real usage, not immediately

Churn drivers are understood, not guessed

3) “Do unit economics survive reality?”

CAC payback computed by channel using recent data

Gross margin direction holds on newer cohorts

Cost to serve mapped to the product, not averaged away

4) “If we are wrong, how does this fail?”

Does it fail fast with clear signals?

Or does it burn slowly with no leading indicators?

5) “Can this team answer quickly?”

Speed matters. If simple questions take a week, investors assume ops are messy.

How to become investor-ready before you start outreach

This is the practical fix.

Step 1: Lock definitions

Write down what ARR, revenue, churn, CAC, margin mean in your business.

Use the same definitions everywhere.

Step 2: Create a single truth pack

One place investors can trust, containing:

Runway (tied to bank and burn)

Cohorts (by segment, with discount flags)

Gross margin direction (by plan or SKU)

CAC payback (latest period, by channel)

Burn multiple (same period as growth)

Step 3: Pre-answer the sceptical questions

If you cannot answer in minutes, you are not ready.

Build short, evidence-backed responses to the top 20 questions you always get.

Step 4: Make updates boring

Boring is good.

Same metrics, same definitions, same cadence.

That is how you build trust.

Founders rarely get told what actually broke.

We run a short 48-hour investor readiness sprint that shows where conviction leaks and what investors quietly flag before rounds stall.

FAQs

1) What’s the difference between pitch readiness and investor readiness?

Pitch readiness is storytelling and presentation. Investor readiness is conviction under sceptical questioning.

2) Why do great decks still fail to raise?

Because the evidence breaks: mismatched KPIs, weak cohorts, unclear unit economics, or a fragile model.

3) What do investors pressure-test first?

Reconciliation (bank, burn, runway), cohort shape, margin direction, CAC payback, and whether the narrative matches the numbers.

4) What is the fastest way to improve investor readiness?

Lock KPI definitions, build a single source of truth, and make diligence answers fast and evidence-backed.