due-diligence

investor-tips

Fundraising

The 10-Minute Test: How Investors Actually Evaluate Early-Stage Startups

Adhrita Nowrin

Jan 29, 2026

How do investors really evaluate startups?

How long do investors take to decide?

Initial conviction is often formed within the first 10 minutes of review, long before formal diligence begins.

Investors do not “decide” to invest in 10 minutes.

They decide whether your deal deserves more attention.

And that decision is fast. Data points on deck review time consistently show investors spend only a few minutes per deck in early screening.

If you fail the first screen, “later diligence” never comes.

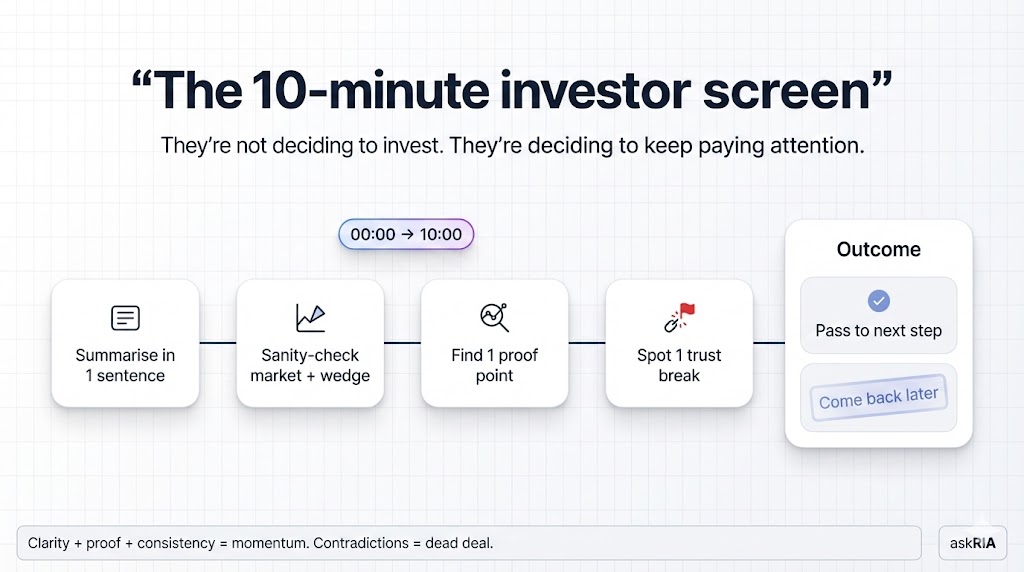

The first 10 minutes after a pitch call

Right after a call, most investors do the same thing:

They try to summarise the company in one sentence.

They sanity-check the market and wedge.

They look for one proof point that makes the story real.

They scan for one thing that breaks trust.

This is not unfair. It is how a high-volume decision process works.

If your company cannot be summarised cleanly, or your proof is thin, the safest move is “pass”.

What investors look for before reading your deck again

In the first pass, investors want answers to five questions.

1) Do we understand what this is?

Who is the buyer?

What is the trigger to buy?

Why does your solution win?

If this is fuzzy, the rest is noise.

2) Is the market big enough for the fund model?

They do not need a perfect TAM slide. They need a believable path to meaningful scale.

3) Is traction real, or is it cosmetic?

They look for traction that has a mechanism:

repeat usage

renewal behaviour

expansion

a repeatable acquisition loop

4) Do the numbers hold together?

They are not auditing you. They are checking for contradictions:

Runway that does not match bank and burn

ARR or revenue definitions that drift across files

A model that only works with perfect assumptions

5) Does this get easier with time, or harder?

Investors are pattern-matching for a business that becomes more predictable:

retention improves or stabilises

gross margin holds or rises

CAC payback moves in the right direction

Pattern recognition vs detailed analysis

Most early-stage screening is pattern recognition.

That does not mean investors are guessing. It means they are using shortcuts learned from thousands of prior deals.

Examples of patterns that trigger “lean in”:

One segment retains clearly better than the rest.

Margin direction improves on newer cohorts.

CAC payback is in a workable corridor, and trending better.

The story and the spreadsheet agree.

Examples of patterns that trigger “lean out”:

Everything is blended, nothing is segmented.

Metrics are inconsistent across deck and model.

Growth is explained by discounts, not repeatability.

The team cannot answer basic questions quickly.

Detailed analysis comes only after the deal survives the first screen.

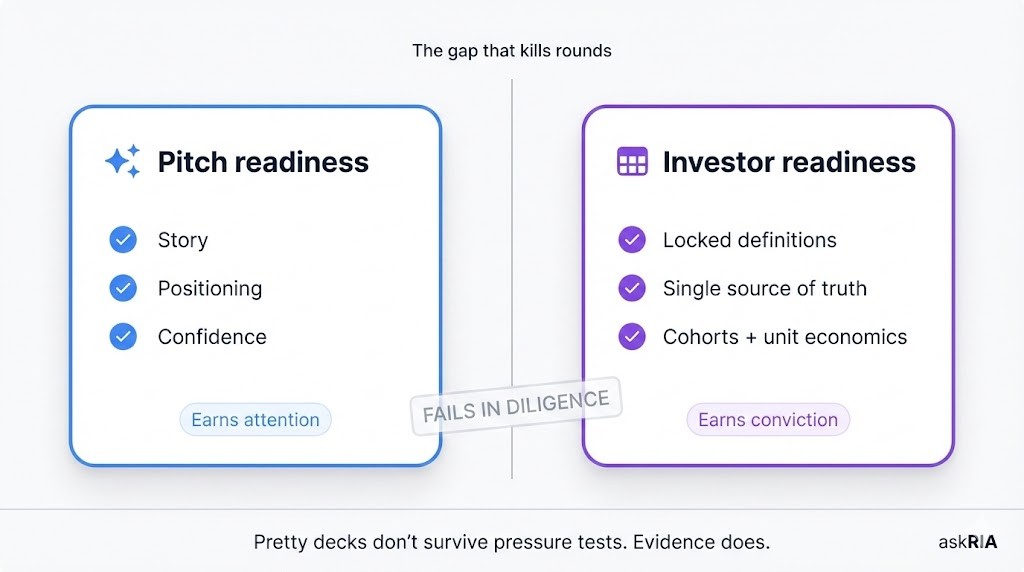

Why “later diligence” is often a myth

Many founders think diligence begins after the second meeting.

In reality, the second meeting is often contingent on passing the first screen.

If the investor cannot build an internal conviction case quickly, they will not spend more time. That is why “we will dig in later” frequently becomes “not a fit”.

Common reasons deals never reach diligence:

unclear ICP and wedge

no cohort story for a recurring model

inconsistent KPI definitions

unit economics that do not survive basic pressure-testing

slow clarification loops

How founders can simulate this test themselves

Do this before outreach. It will save you months.

Step 1: Create a one-page truth pack

One page only. It must include:

Runway (tied to bank and burn)

Cohort chart (2–3 recent cohorts)

Gross margin direction (new vs old cohorts, or by plan)

CAC payback (latest period, ideally by channel)

Burn multiple (same period as growth)

Step 2: Run a timed review

Give someone 10 minutes with the pack and your deck.

Then ask them to answer:

What is this company?

What is the buyer and trigger?

What is the traction mechanism?

What breaks trust?

If they cannot answer, investors will not either.

Step 3: Pressure-test the numbers

Pick 5 numbers and ensure they match everywhere:

bank balance

net burn

runway

ARR or MRR definition

gross margin

Any mismatch is a trust leak.

Step 4: Pre-write the answers to the hard questions

If your answers take days, you lose momentum.

Write short, evidence-backed answers for:

“What changed in the last 60 days?”

“What does retention look like by segment?”

“What is payback by channel?”

“Where does margin break at scale?”

If you want to see how an investor will pressure-test your materials, we run a short 48-hour diligence sprint that surfaces the trust leaks and missing proof points before you start outreach.

FAQs

1) How long do investors take to decide?

Initial conviction is often formed within minutes, long before formal diligence begins.

2) What do investors look for in the first 10 minutes?

Clarity, one real proof point, consistent numbers, and a model that does not collapse under basic questions.

3) What is the fastest way to improve first-pass outcomes?

Stop relying on the deck. Build a one-page truth pack with runway, cohorts, margin direction, payback, and burn multiple.

4) Why do investors say “let’s revisit later”?

Because the deal did not survive the first screen and they cannot build conviction from the current evidence.