Fundraising

investor-tips

due-diligence

Why Investors Say “Come Back Later” (And What They’re Really Seeing)

Adhrita Nowrin

Jan 23, 2026

Founders get confused by vague investor rejection.

Why do investors say “come back later”?

Because something did not hold structurally. Most often this is market clarity, traction quality, or narrative coherence, even when the idea itself is interesting.

Most founders hear “come back later” and assume it’s timing.

It usually is not.

In practice, it means: we do not yet have conviction, and we do not see a clean path to it based on the current evidence.

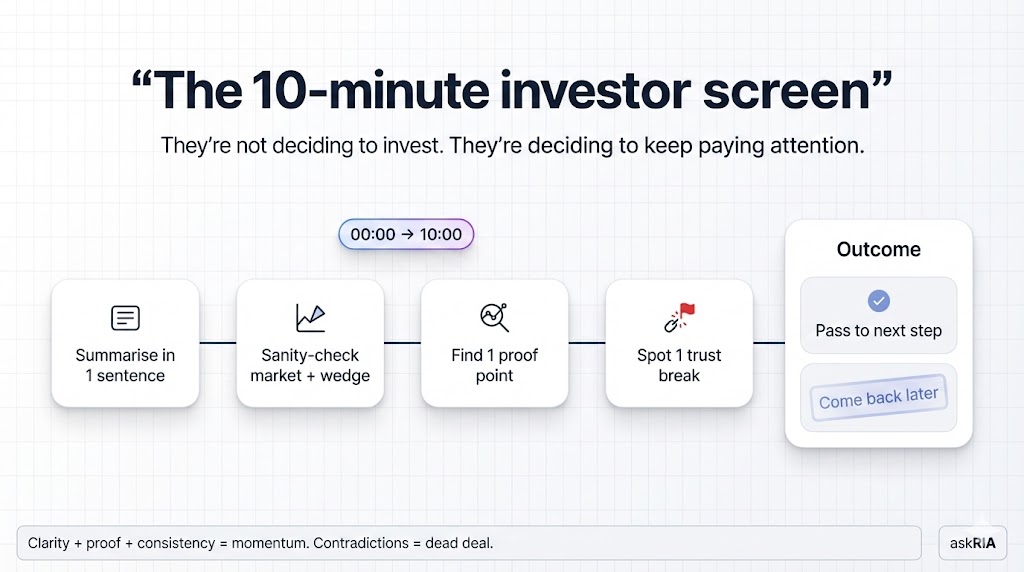

Investors are not deciding whether to invest.

They are deciding whether to keep allocating attention.

“Come back later” is how attention gets paused.

The 10-minute investor decision reality

Investors rarely reject companies in partner meetings.

They filter before that.

The first pass is a structural test:

Do we clearly understand what this is, who it is for, and why now?

Is traction real, repeatable, and explained?

Are the numbers coherent enough to trust?

Could this outcome matter for our fund model?

If any of these are weak, the default response is deferral.

What “not now” actually encodes

Most “come back later” outcomes fall into four buckets.

1) Market clarity doubt

ICP is vague, or keeps changing shifting

The wedge is unclear.

The category exists, but the company’s position does not

What investors are looking for: a tight first user, a clear buying trigger, and why this company wins that first use case.

2) Traction quality doubt

Growth exists, but the engine is not legible

Demand is channel-dependent or incentive-driven

Momentum is visible, repeatability is not

What investors are looking for: cohorts, a stable acquisition path, and a reason retention and margins improve over time.

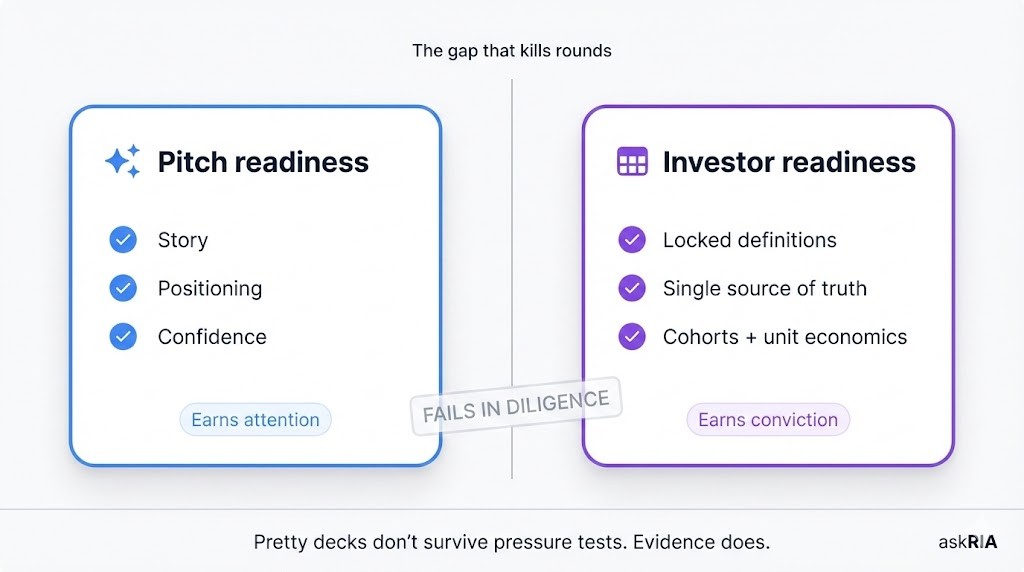

3) Narrative coherence doubt

The deck says one thing, the model implies another.

KPIs drift across files.

Definitions are inconsistent (ARR vs bookings vs revenue).

What investors are looking for: one source of truth, locked definitions, and a story that survives contact with the data.

4) Founder execution doubt

Priorities are scattered

Milestones are unclear

The roadmap reads aspirational rather than operational

What investors are looking for: a tight 90-day plan with measurable outputs.

The hidden signals investors track

These rarely get articulated, but they drive conviction.

1) Evidence density

How much proof exists per claim?

High-conviction rooms show:

Cohort retention and expansion

CAC and payback by channel

Gross margin direction by plan or SKU

Sales cycle and win-rate by segment

Bank and burn reconciliation

Low-conviction rooms show adjectives.

2) Definition hygiene

If ARR appears in three places, it must mean the same thing in all three places.

When definitions drift, investors stop debating the number and start discounting the system.

3) Clarification loop speed

How fast can you answer:

What is runway, reconciled to bank?

What does retention look like by segment?

What is CAC payback in the latest quarter, by channel?

Fast answers signal control.

Slow answers signal operational debt.

4) Downside containment

Investors also underwrite failure.

Clear unit economics and runway discipline reduce perceived downside and keep attention.

Why follow-ups rarely change outcomes

Follow-ups fail because they do not resolve the original doubt.

Founders send growth updates, hiring updates, or product launches.

What changes outcomes is new evidence that closes the specific gap.

Examples:

A clarified ICP and wedge

New cohorts that stabilise

Payback improving from pricing or channel mix

A repeatable acquisition path proven twice

If the doubt is not named, it cannot be resolved.

How to diagnose this before outreach

Run this pre-flight check before you book meetings.

Step 1: Run a “single source of truth” test

Reconcile these across deck, model, and updates:

Bank balance

Net burn

Runway

ARR or MRR (defined clearly)

Gross margin

If they don’t match, fix this first.

Step 2: Build a 1-page “traction truth” view

Include:

2-3 cohorts (retention and expansion)

CAC payback by channel (latest quarter)

Gross margin direction (newer cohorts vs older cohorts)

One sentence explaining the growth engine

Step 3: Write the anti-handwave narrative

Replace adjectives with falsifiable statements:

Not “strong demand”, but “win-rate is X% in segment Y, cycle is Z days”

Not “great retention”, but “cohorts flatten by month N in segment Y”

Not “efficient growth”, but “payback improved because channel mix shifted and pricing moved”

Step 4: Pre-answer the top 10 investor questions

If answers are not available within minutes, deferrals follow.

Founders rarely get told what actually broke.

We run a short 48-hour investor readiness sprint that shows what investors quietly flag and where conviction leaks before meetings. Book a Call